Will Ethereum Surpass Bitcoin?

Summary:

Token Terrier believes that the likelihood of Ethereum's bull case is 50%+ and Bitcoin's is 80%+. In 10 years, we believe it is not only plausible that Bitcoin and Ether will both be $30T+ assets, but actually the most likely outcome.

Bitcoin as Digital Gold and Ethereum as a platform for decentralized financial (DeFi) applications are not just narratives; these two use cases require fundamentally different blockchain consensus mechanisms, Proof of Work (PoW) and Proof of Stake (PoS), with different assumptions about security and scalability.

In the long-run, there will likely be only one dominant Proof of Work blockchain, the Bitcoin blockchain, as well as a myriad of Proof of Stake (PoS) blockchains, anchored to Bitcoin's Proof of Work, of which Ethereum will be the most valuable.

Bitcoin and Ethereum are creating a financial system closely resembling that which existed in the United States under the Gold Standard from 1834 to 1933. During that era, gold was the sole arbiter of financial value, but relied upon a distributed banking network to scale its transactional capacity. Bitcoin will likely serve as Digital Gold and Ethereum as the world’s Banking and Financial Network in the emerging Network Age.

Token Terrier believes that Ethereum will become the dominant platform for DeFi applications, a market worth between 2% and 3% of global annual GDP, making Ether a $30T+ global transactional currency.

Bitcoin and Ethereum are the two highest conviction assets in the ₿EST Portfolio.

Background

Ethereum is the now the single best performing asset in the ₿EST Portfolio, up 25x since my original blog post in December 2019, despite being the lowest conviction asset at the time I announced the portfolio.

Ethereum is now the second highest conviction asset, behind only Bitcoin, in the ₿EST Portfolio.

If you’ve been following my blog for a while, this is probably not a surprise for you. You have likely read my increasing optimism about the future of Ethereum starting in January 2020, continuing in May 2020, August 2020, and most recently November 2020 when I asked the question “Ethereum: A New, Digital Constitution?”

My newfound conviction in Ethereum culminated in making investments in the DeFi Pulse Index (DPI) and Index Cooperative (INDEX), and launching the ₿EST Portfolio on the Ethereum blockchain on January 26, 2021 under the ticker symbol, BEST.

At inception, BEST had a 50% allocation to Bitcoin and 20% allocation to Ether (ETH), the native currency of Ethereum.

Due to relative price movements alone, Ether now makes up >27% of the portfolio and Bitcoin has dropped to ~39% despite rising ~80% in US Dollar value since inception. Ethereum-based assets now represent more than 60% of the ₿EST Portfolio’s value.

The price of Ether has skyrocketed ~185% over the same period and the ratio of Ethereum’s market capitalization relative to Bitcoin’s is at levels not seen since the last Crypto bull market in early 2018.

Bitcoin and Ether are currently the only currencies in the ₿EST Portfolio; the other assets are not currencies, and should be valued more like stocks by discounting their expected future cash flows to the present. This is why I generally prefer to use the term cryptoasset instead of the more colloquial cryptocurrency.

Given that Ether and Bitcoin are both cryptocurrencies, ostensibly in competition with one another, it’s worth asking the question: Will Ether become more valuable than Bitcoin?

Has Ethereum already surpassed Bitcoin?

By many metrics, Ethereum has already surpassed Bitcoin. Let’s review some of the most important metrics of these two respective blockchain networks to see how they compare against one another and discover relevant trends.

Transactions

Ethereum has processed more on-chain transactions than Bitcoin since June 2017, and now processes ~5x the number of on-chain transactions.

Active Addresses

Bitcoin maintains a nearly 2x lead in active addresses that Ethereum has never closed in its history and there are no signs of it closing the gap in 2021.

New Addresses

New addresses tells the same story as active addresses. Bitcoin is currently adding 2.5x new active addresses per day as Ethereum.

On-Chain Volume

Over the course of 2021 Ethereum has closed the gap between itself and Bitcoin in on-chain volume. In just the past week alone it dramatically surpassed Bitcoin by this dimension. This is a very interesting metric to watch. Ethereum also closed this gap in June 2017, September 2017, and January 2018 before losing its lead for all the remainder of 2018, all of 2019, and all but a few times in 2020.

Miner Revenue

Miner revenue is important because it represents the security budget of any Proof of Work (PoW) blockchain. Ethereum’s miner revenue, the sum of transaction fees and mining rewards (also known as the block subsidy), is now on-par with Bitcoin's block rewards in 2021. Like on-chain volume, this is not the first time Ethereum closed the gap before losing its lead. Ethereum miner revenue exceeded Bitcoin’s in June 2017 and February 2018 before Bitcoin regained substantial leads for the majority of 2018, all of 2019, and all but a few moments in 2020.

Decentralized Applications

There is no contest on this metric. Ethereum is clearly the dominant smart contract platform for decentralized financial (DeFi) applications. Bitcoin hosts very few DeFi applications with limited usage due to its fundamental weakness of not having a built-in programming language with which to write smart contracts. Ethereum was created because its founder, Vitalik Buterin, discovered through trial-and-error that it was not feasible to build complex smart contracts on Bitcoin. Simply put, DeFi cannot be built on Bitcoin alone.

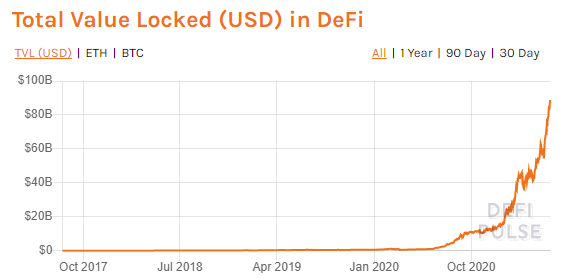

Ethereum now has >$85B in value locked in DeFi applications, a >120x increase from the start of 2020.

It is not difficult to imagine that after Ethereum transitions from a PoW blockchain capable of processing only 15 transactions per second to a PoS blockchain capable of 100,000+ transactions per second that the value locked in DeFi could reach $1T within a year.

Market Capitalization

Bitcoin remains the undisputed leader in market capitalization, currently supporting a network value >2x that of Ethereum. However, Ethereum has recently gained a lot of traction as the exchange rate between ETH and BTC now exceeds 0.07 BTC, the highest level the rate has reached since July 2018.

Bitcoin Maximalists should not feel overconfident in their belief that Bitcoin will always maintain its market capitalization dominance over Ethereum. If Ethereum boasts a booming ecosystem of DeFi applications with exponential growth in transaction throughput with equivalent security guarantees, is it just a matter of time before Ethereum becomes more valuable than Bitcoin?

Ethereum Growth Catalysts

As I’ve mentioned in previous posts, Ethereum has two major catalysts on the near-term horizon that have the potential to propel the network to new heights of success.

EIP-1559: Ethereum becomes both a currency and a capital asset.

In May 2020, I wrote:

“Ethereum’s monetary policy has always puzzled me. Unlike Bitcoin, it does not have a credible commitment to a fixed supply, and its liquidity is less than one-quarter that of Bitcoin’s. This makes it less suitable than Bitcoin for the role of global reserve currency.

EIP-1559 enables Ethereum to capture and accrue value, even in a world where Bitcoin becomes the global reserve currency and the “King of Collateral” on the Ethereum network.

EIP-1559 would “burn” the majority of ether in the transaction fee of each block, reducing the supply of ether as the demand for computation on the Ethereum network increases; this should cause the price of ether in USD terms to rise with the success of the Ethereum network.”

Ethereum Improvement Proposal (EIP) 1559 is now scheduled to go live on the Ethereum mainnet sometime in July or August 2021. Justin Drake, an Ethereum 2.0 researcher, estimates that the implementation of EIP-1559 will result in 70% of Ethereum’s total transaction fees being burned, or permanently removed, from the network’s circulating supply. In theory, burning Ether transaction fees should function much like a corporation using its cash flows to buy back its own stock, returning earnings to holders through price appreciation of the asset.

This means that Ether’s value can be modeled with more traditional and straightforward techniques, like discounted cash flows (DCF), to determine its fundamental, or intrinsic value.

The Merge: Ethereum becomes a Proof of Stake (PoS) blockchain.

Ethereum’s transition from a PoW to a PoS blockchain, also called The Merge, is estimated to occur in the first quarter of 2022. The switch to PoS is critical for Ethereum’s scalability and will enable it to implement sharding, a scaling technology that should theoretically enable the transaction throughput of the network to grow from its current theoretical upper limit of 1,000 to 3,000 transactions per second to 100,000+ transactions per second.

Aside from the very important improvements to scalability, the Merge significantly reduces Ethereum’s energy usage and modifies its security guarantees. PoS secures the network through validators, who deposit or stake their Ether to earn block rewards, instead of through miners who currently operate energy intensive mining hardware to find the solution to a computational puzzle every block and earn block rewards. As a result of this transition, Justin Drake estimates that a ~25% combined staking APR, from both new currency issuance and fee rewards, after the Merge!!

Ryan Berckmans, the creator of ethereumcashflow.com, incorporates EIP-1559 and the Merge as catalysts into a discounted cash flow (DCF) valuation model. He found that these catalysts support a value of ~$17k per ETH, implying a ~4x upside from current price levels. Within weeks of publishing his analysis, he refreshed his valuation model to reflect the recent acceleration in Ethereum’s transaction fee growth and found a price of $56k per ETH, implying a nearly $7 trillion valuation for Ethereum.

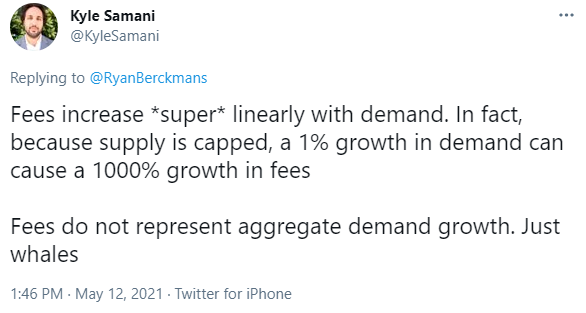

In my view, Berckmans’ model significantly overestimates Ethereum’s total transaction fees over the next 3 years as Ethereum scaling will exponentially increase throughput (i.e. supply of transactions), and hence lower the network fees, even as demand for transactions scales. Kyle Samani of Multicoin Capital makes the astute observation that elevated fees right now are not representative of growth in transaction demand:

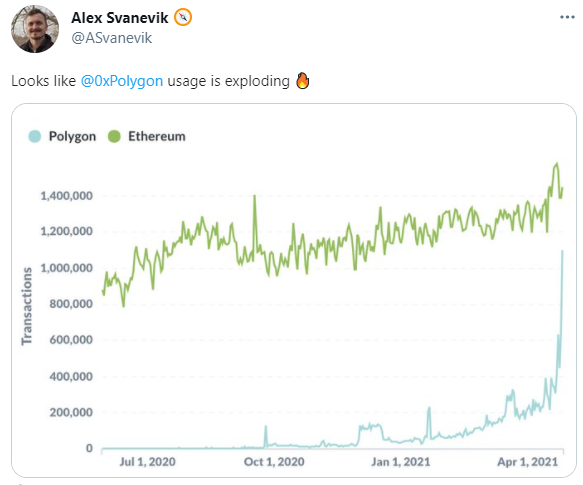

Following Samani’s logic, even a 1% growth in throughput could lead to a 90%+ reduction in fees! We saw this market dynamic at work just a few weeks ago when the median transaction fee on Ethereum briefly fell from ~$12 to ~$2 over the course of a week, as throughput demand shifted from Ethereum’s base layer to Polygon, a layer 2 scaling solution built on top of Ethereum.

Yet, over a longer time horizon, it is realistic that scaling transactions would lead to induced demand, and as a consequence, Ethereum’s total transaction fees would eventually increase alongside throughput. Berckmans’ analysis provides a useful range of possible values for what Ethereum’s valuation could be, assuming induced demand, after the implementation of EIP-1559 and a successful transition to PoS.

Objective > Subjective

Many in the Ethereum community, including Ethereum’s founder, Vitalik Buterin, believe that PoS is a “superior blockchain security mechanism” compared to PoW.

Many Ethereum Maximalists, those who believe that Ethereum will surpass and potentially even obsolete Bitcoin, argue that Ethereum will scale to 100,000+ transactions with equivalent or better security than Bitcoin. They argue that “Bitcoin is Digital Gold” has been a successful narrative for adoption, but that Bitcoin will be an inferior blockchain across every dimension compared to Ethereum.

While I celebrate the entrepreneurial and optimistic spirit of PoS researchers, I am deeply skeptical of their claims.

I think the $50T question is this, “Does PoS really achieve transactional scalability without sacrificing Proof of Work’s security and decentralization?“

Firstly, Bitcoin’s PoW consensus algorithm has now operated with 99.999%+ uptime, securing billions, currently trillions in value, for over a decade. Vitalik Buterin, other Ethereum researchers, and many others have been working since 2014 to design PoS consensus algorithms that they hope will be secure as PoW in the real-world. As of today’s writing, the four most valuable PoS blockchains secure ~$200 billion in value; by comparison, the four most valuable PoW blockchains, which currently include both Bitcoin and Ethereum, collectively secure over $1.5 trillion.

Why has it been so difficult for researchers to design a PoS algorithm that is theoretically more secure than PoW?

The reason is simple: it has been mathematically proven that PoS requires a source of trust external to its blockchain while PoW does not.

“...it is impossible to determine the “true” transaction history in a PoS blockchain without an additional source of trust. In other words, the idea of weak subjectivity promulgated by Vitalk Buterin (creator of Ethereum) is a hard requirement in the design of any PoS blockchain.”

Not all PoS blockchain proponents believe that PoW is wasteful or will become obsolete. Ethan Buchman, the creator of Cosmos, a PoS blockchain, who worked closely with Ethereum researchers to design Ethereum’s PoS consensus algorithm, calls himself a “closet Bitcoin Maximalist”.

In his blog post, Bitcoin Turns 10, he explains the importance of Bitcoin’s PoW blockchain for the long-term sustainability of PoS blockchains.

“I tend to believe there should be one, and only one, big, bad, public, Proof-of-Work blockchain.

Why? I think the thermodynamic immutability that Proof-of-Work provides has tremendous value that is unlike anything we know how to produce with Proof-of-Stake systems. It is a hedge against the failure of certain socioeconomic relationships, both for the individual and for civilization writ large. It is a precious digital, if you will. If gold represents the capacity to mine, mold, and protect pretty things, Bitcoin represents the same, for digital things.

As for Proof-of-Stake systems, I suspect they should be grounded in Bitcoin’s thermodynamics in some way...I would not expect the Proof-of-Stake systems to be sustainable.”

I do not believe that “Bitcoin is Digital Gold” is solely a narrative. Digital Gold is an analogy to communicate in simple terms that Bitcoin’s security is rooted in objective reality, the expenditure of energy, and is external to human affairs. The process of creating new bitcoins is called mining because it converts energy, or work, into financial value, much like mining gold does in the physical world.

In November 2020, I wrote about a conversation between Vitalik Buterin and Tyler Cowen, one of the economist bloggers at MarginalRevolution. In that conversation, Tyler Cowen commented:

“...Ethereum 2.0 it’s fundamentally an act of governance and institutional creation. In some ways it’s like the American Constitutional Convention and not very algorithmic...People will trust say you, and the Foundation, and Ether more than they will trust a lot of other institutions.”

Vitalik nodded in agreement. Ethereum, and all PoS blockchains, are fundamentally human institutions that rely on trust to generate social scalability. PoS blockchains are more analogous to America’s Constitutional government than they are to gold as they derive their security through penalties, like checks and balances in the American Constitution, rather than rewards. If Bitcoin is Digital Gold, then Ethereum 2.0 may be a Digital Government.

I tend to agree with Ethan Buchman’s view that there will be a myriad of PoS blockchains and that there will be just one PoW blockchain, the Bitcoin blockchain, to root them all in physical reality.

If this view is correct, then Ethereum’s PoS blockchain may need to leverage Bitcoin as a trust anchor to be sustainable in the long-term. If Ethereum anchored itself to the Bitcoin blockchain, it would create a financial system that would closely resemble that which existed in the United States under the Gold Standard from 1834 to 1933. During that era, gold was the sole arbiter of financial value, but relied upon a distributed commercial banking network to scale its transactional capacity.

Bitcoin and Ethereum: A Symbiotic Relationship

If I am right that Bitcoin is analogous to Gold and that Ethereum is analogous to Government, then I believe that Bitcoin and Ethereum will grow exponentially in a symbiotic relationship together over the coming decade.

In How Many Bitcoins do you have?, I outlined the case for Bitcoin as Digital Gold having a total addressable market (TAM) in the $30T - $70T range, implying a price per bitcoin of $1.4m to $3.3m at equilibrium. My confidence in this thesis has increased since I published it in November 2019. While my conviction in Ethereum has grown materially over time, I’ve never written down my long-term investment thesis for Ethereum. Let’s remedy that right now.

How should we estimate Ethereum’s long-term potential?

If we are moving towards a global financial system resembling that of the late 1800s, in which Bitcoin is Digital Gold, then Ethereum is a decentralized global banking and financial network.

How large is the total opportunity for creating and capturing the value of this market?

In Yes … I Read the Whitepaper, Arthur Hayes estimates that customers paid ~$2.7 trillion, or between 2% and 3% of global GDP, for banking and financial services in 2020.

If real GDP grows 4% per year and Ethereum captures the financial industry’s share of global GDP, it would be capturing cash flows of ~$4 trillion per year. Assuming Ethereum’s success benefits humanity by reducing financial transaction costs, even if the financial industry’s share of global GDP dropped to 1%, a 50% reduction in transaction costs, Ethereum would still be generating ~$2 trillion per year in cash flows. Over time, the S&P 500 trades at roughly 16x earnings. If Ether traded at the same multiple as the S&P 500 has historically, then Ethereum’s market capitalization would be ~$32 trillion, roughly ~70x the current market value. In this world, Ether would function as a borderless, global transactional currency.

In my subjective view, over the next 10 years, the odds of Ethereum's bull case are at least 50% and Bitcoin's bull case is now 80%+. It is not only plausible that Bitcoin and Ether will both be $30T+ assets, but actually the most likely outcome.

What about the near and medium term?

I believe there is a less than 20% chance of Ethereum surpassing Bitcoin in market capitalization before 2023.

Firstly, Bitcoin initiated this latest crypto bull market in September 2020. Bitcoins’ price grew from ~$12k at the beginning of September to ~$58k at the end of March 2021. In November 2020, I wrote that the new Bitcoin bull market was being driven by the explosion of DeFi, corporate treasuries seeking an inflation hedge, and increased retail adoption from PayPal launching a cryptocurrency service for its 305 million registered customers.

Secondly, the market still appears to be valuing all other cryptoassets, including Ethereum, as high beta assets relative to Bitcoin. For example, Ether’s daily price correlation with Bitcoin’s was ~0.94 during 2020, but grew ~2x in value relative to Bitcoin, demonstrating that the market was valuing Ethereum as a high beta asset. Furthermore, the ETH / BTC exchange rate did not break above 0.04 until the end of April, and did so along with many other so-called “altcoins” like DOGE and XRP. These data points lead me to believe that the market is still valuing Ethereum as a high beta asset rather than as a differentiated network undergoing two major catalysts.

In the short-term, I believe new inflows from fiat currencies into the Cryptoasset ecosystem in the next leg of this bull market will flow primarily from institutional investors and indiscriminate retail investors.

Institutional investors, primarily driven by career risk will hesitate to add Ethereum, a less valuable blockchain adopting a new, experimental consensus algorithm in the near future, to their balance sheets. Instead, they will adopt a battle-tested, even “boring” blockchain, with a 10+ year track record that Tesla, Square, and Microstrategy, and most likely other S&P 500 companies that we are currently unaware of, have already adopted as a treasury reserve asset. Unfortunately, for an institution investing on behalf of clients, buying Ether is the sort of decision that gets you fired if it goes poorly.

On the other hand, indiscriminate retail investors are driven by FOMO and unit bias. They will “spray and pray” into cryptoassets with lower market capitalizations and lower unit prices like Ethereum and Dogecoin hoping they “get rich quick” by buying “the next Bitcoin”.

SoonTM

Ethereum has been promising a transition to PoS since 2014. The Ethereum community has missed so many arbitrary deadlines for upgrades to the network that the response to the question “When do you think this will be shipped?” has become a commonplace meme.

While Ethereum’s PoS consensus algorithm has been running in parallel with PoW since December 2020, one cannot discount the possibility that the Merge may slip its Q1 2022 deadline.

If Ethereum misses the deadline for the Merge, path dependency alone may be enough to propel Bitcoin into the multiple trillions of dollars during this Bull Market, cementing Bitcoin’s status as the global reserve currency of the Internet, before Ethereum’s PoS Consensus mechanism ever has a chance to prove itself in the world.

Conclusion

Ethereum and Bitcoin may be competing for status as the premier store-of-value cryptocurrency, but that should not prevent the prudent investor from having an allocation to both assets.

One should not discount the possibility that a symbiotic relationship will develop between the Ethereum and Bitcoin blockchains. In 10 years, the most likely outcome may be that Bitcoin cements itself as Digital Gold and Ethereum takes its place as the world’s dominant global banking and financial network.

In my view, the market opportunities for the respective assets are so large, and the probability of success so underestimated by investors, that it would be irresponsible to not have an allocation to both cryptocurrencies.

For these reasons, Bitcoin and Ethereum remain the two highest conviction assets in the ₿EST Portfolio.

Acknowledgements

Thank you Daniel O’Connell for your support with editing and design.

Thank you Kyle Kistner, Lemonade Alpha, Patrick Dugan, and Ryan Berckmans for reviewing and providing feedback.