An Updated Bull Case for Index Cooperative

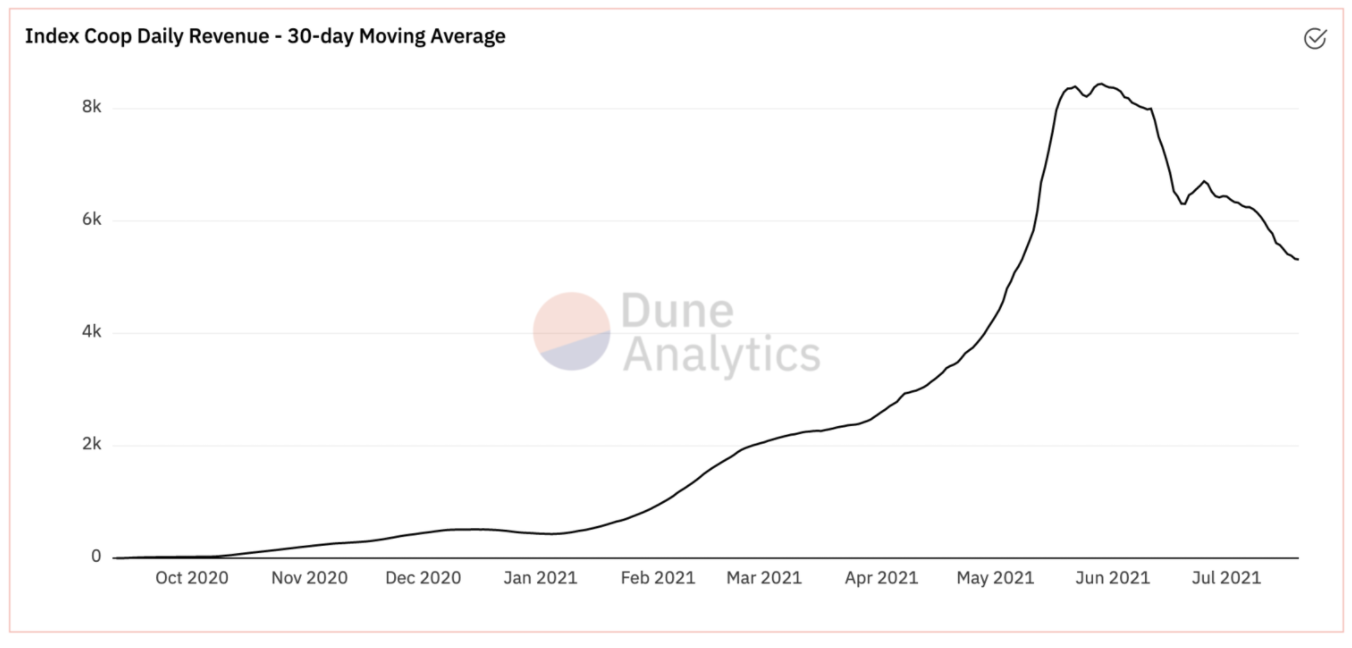

A few months ago, Thomas Hepner published an essay—winning the Index Creative Challenge along the way—explaining why he was investing in the Index Cooperative’s governance token ($INDEX). Since that post, the Index Cooperative’s revenue has grown nearly 14x and INDEX has increased in value nearly 5x.

Credit: @jdcook and @danielofconnell

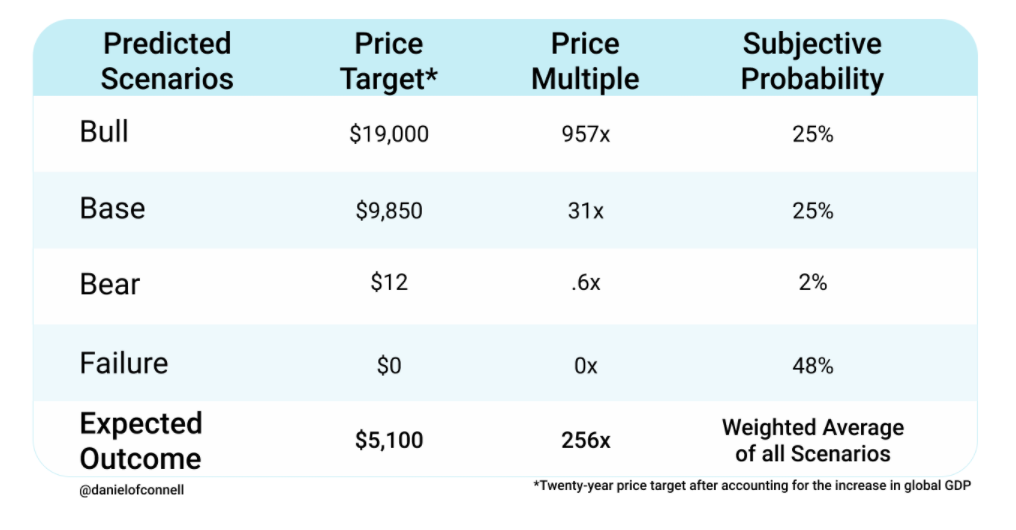

This article expands on the bull case made in that essay with a subjective probability-weighted scenario analysis. I arrived at an expected value of a $51B market cap, implying a 190x upside from here. If crypto succeeds at absorbing any significant portion of the global financial system, I believe the Index Cooperative will likely be extremely profitable, generating billions in annual cash flow.

What is INDEX?

The Index Coop is a Decentralized Autonomous Organization (DAO) with the goal of becoming to Decentralized Finance (DeFi) what companies like Vanguard and Blackrock are to Traditional Finance (TradFi). Through partnerships and integrations with pioneering teams and projects in the cryptoasset ecosystem, they are well on their way.

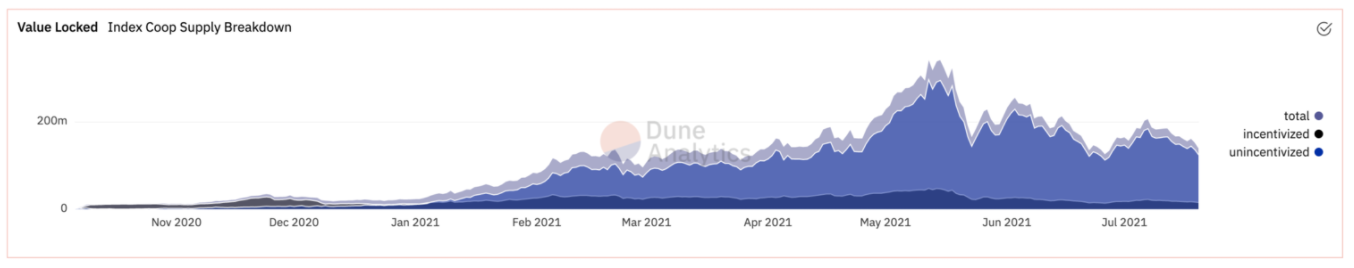

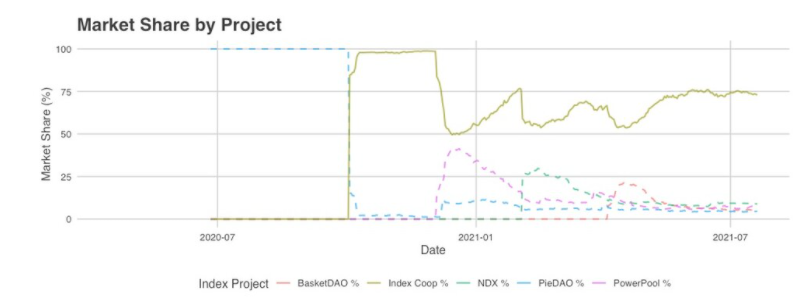

Credit: @josephdcook

The Coop reigns as the market leader in every market they’re involved in, they have $140MM under management, 3x the Assets Under Management (AUM) of their competitors combined. If Index succeeds at their goal of becoming the “Crypto Blackrock,” they will likely hold $15T in twenty years, over 100,000x increase from today.

Credit: @josephdcook and @danielofconnell

Valuation:

Analyzing over 30 possible outcomes, my twenty-year expected value per token is $5,100, with a 25% chance of being worth significantly more than that. To arrive at this base case, I developed a subjective probability-weighted scenario analysis with Bull and Bear projections:

Methodology

To see how I got there, let’s take a look at the three variables used in my model:

Variables:

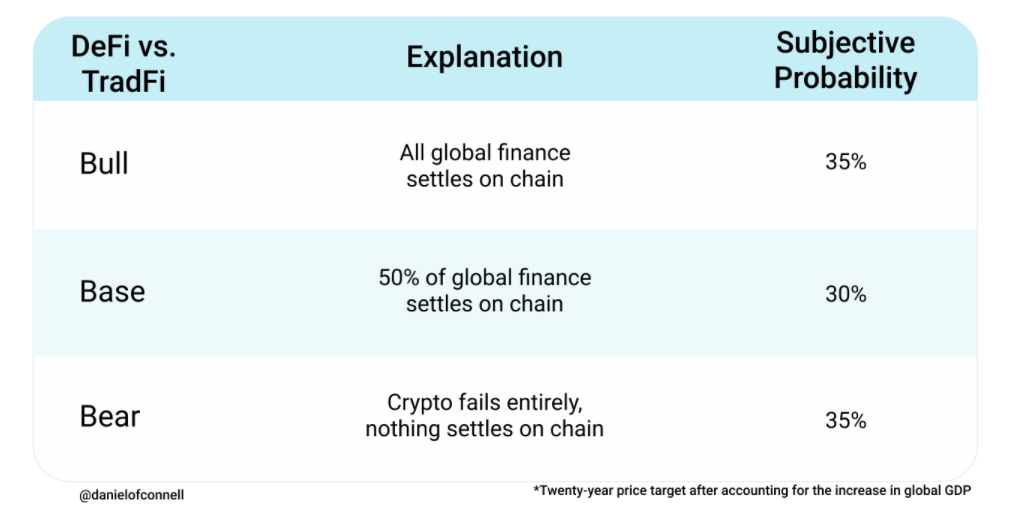

DeFi Penetration: What percentage of the TradFi market will DeFi capture?

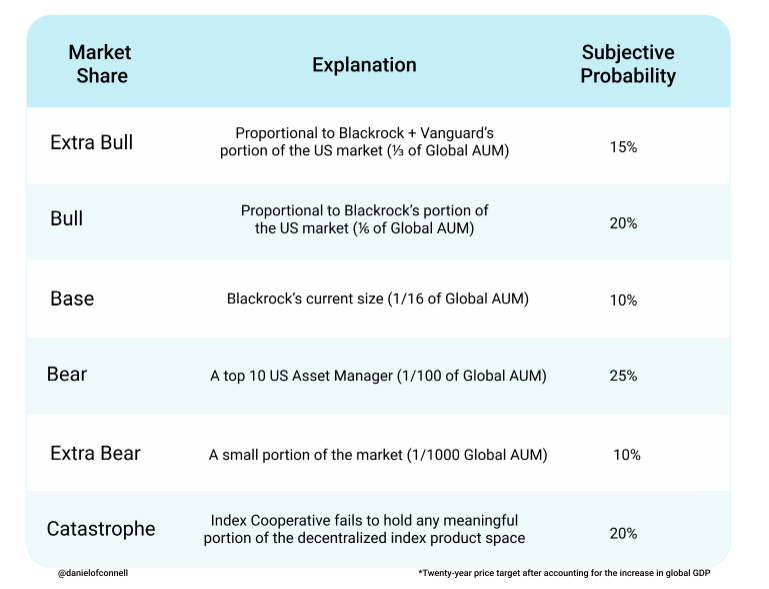

Product Market Share: What percentage of the global decentralized structured index product market will Index Cooperative hold?

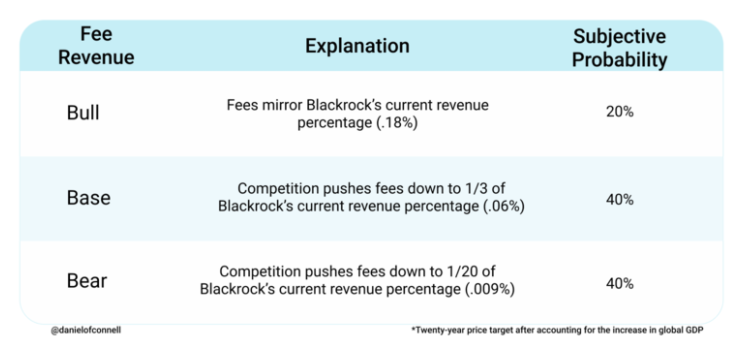

Fee Revenue: How much fee revenue will the market create for Index Cooperative's products?

The tables below summarize the different inputs for each variable.

DeFi Penetration:

I expect Crypto to either succeed or fail at absorbing the totality of global finance. I will be surprised if it ends up settling only a portion of all financial transactions.

Product Market Share:

The Index Cooperative is the clear market leader in Decentralized Index Products. They have 3x the Total Value Locked (TVL) of their competitors combined and carefully crafted, innovative products.

As blockchain technology enables more global trade, it’s possible Index Cooperative will hold a portion of the global market proportional to Blackrock and Vanguard’s combined portion of the US Market (⅓ of Global AUM).

It’s also possible that Index Cooperative fails to survive for the long haul due to the rapidly transforming market.

Fee Revenue:

You’ll notice that my bull case for fee revenue (.18%) is well below that generated by Index Cooperative’s current revenue structure:

DPI, MVI: 0.95% streaming fee

FLI-Suite: 1.95% streaming fee, plus a .1% mint/redeem fee

I expect that through competition the efficiencies of DeFi will be passed on to consumers. We already see this happening in the DeFi space. Uniswap has fees turned off by default, but in situations of need can turn them on to be between 3 and 7.5 basis points. This is between 95% and 98% lower than Coinbase’s US fee of 150 bps per trade.

The Valuation

The valuation analysis is based on 31 probability-weighted scenarios. (Complete failure of INDEX and/or DeFi were considered one scenario. The other 30 are scenarios that assume some degree of survival for both INDEX and DeFi.) See the full Probability Analysis here!

Our Bull case is based on a weighted average of the 25% of scenarios that are most profitable.

Our Base case is the weighted average of the 25% of scenarios between the bull cases and bear cases.

Our Bear case is the 2% of the time that INDEX is worth less than it is now but still holds some value.

“Failure” is the 48% of the time that either Crypto fails to capture any of global finance or Index fails to hold a significant portion of the decentralized index product market.

INDEX Could go Even Higher:

One could argue that this model is overly conservative on revenue fees. Revenue lost to efficiency could be made up by product innovation (i.e. intrinsic productivity). This could also be counteracted by the global trading volume unlocked by crypto’s accessibility: you only need internet access.

Also, our market cap projections are based on Blackrock’s revenue multiple of 8x. At maturity, Index Cooperative could command a higher revenue multiple than this due to higher profit margins from increased efficiency of operations.

Unlike Blackrock, Index Cooperative is neither an asset custodian nor an operator of data centers and has no physical office locations. This decrease in overhead could return a higher share of revenue as profits to token-holders than assumed for purposes of this analysis.

Conclusion

I believe INDEX continues to represent an incredible long-term investment opportunity, with asymmetric returns. Yes, there is a 48% chance of it becoming worth $0, but this risk is outweighed by the upside: there’s a 25% chance that it becomes worth more than $190B, an opportunity that would multiply your investment 950x.

In the 31 scenarios I ran, there were only two scenarios in which INDEX maintains some value while falling below its current value. I believe most of the risk comes with the failure of crypto itself. If you believe that crypto will successfully absorb a significant portion of traditional finance, it’s a pretty safe bet that INDEX succeeds with it.

For these reasons, I believe INDEX continues to deserve an allocation in any crypto asset investor’s portfolio.

Huge thanks to @marshmellow and @LemonadeAlpha for editing help, and thanks to @Thomas_Hepner for guiding me through this process and spending hours arguing with me over 1% differences in probability.