November 2020 Update: Bull Markets in Everything

1. The United States is on the cusp of a historic Economic Boom!

A little over a month ago, I made the prediction on Twitter that in 2021, the U.S. economy will grow faster than at any other time in my life thus far.

The conventional wisdom right now is that we are in a historic recession, maybe even depression, and that economic conditions are likely to continue to remain depressed or even deteriorate if additional lockdowns are imposed as a result of the second wave of the Coronavirus now underway in the United States and Europe.

The conventional wisdom is dead wrong.

The economy fell to 15% below trend between February and April 2020, but then rebounded strongly in the summer and is now running 5% below trend.

Source: Jason Furman, Chairman of President Obama’s CEO

One can see that after recovering from the initial shock and relaxation of strict lockdowns in the United States that GDP has been stuck at about 5% below trend since July 2020.

However, GDP is a broad aggregate of economic activity. The reality is that organizations that deal in the world of atoms have struggled greatly this year while those that move bits have outperformed wildly. Most schools and daycares are closed, people dine-in at restaurants much less frequently than before Covid, and there is far less travel. The relative stock market performance of Boeing and Zoom summarize this underlying dynamic neatly: Boeing is down 47% this year whereas Zoom is up nearly 6x!

Defeating the Coronavirus will unlock the Atoms Economy. This will not merely enable the economy to recover to its pre-Crisis trend, but empower it to surge above as it absorbs the productivity gains from the so-called “Digital Transformation” that has taken place during the Coronavirus Crisis.

Productivity will “step-up” to a higher level after the Coronavirus is defeated and that appears to be coming true much sooner than many, including myself, anticipated. Just this morning, I woke up to see that Pfizer announced that their Covid-19 vaccine is more than 90% effective and that the FDA is likely to give emergency authorization to fast-track the vaccine by the third week of November.

This is astounding news and the market recognized it! In early morning trading, the Dow Jones Industrial Average (i.e. the Atoms Economy) was up nearly 6% and the Nasdaq (i.e. the Bits Economy) was not even up 1%. Shares of Zoom actually fell 17% today!

2. It’s Official - The Bull Market in Housing has Begun!

In my August 2020 Thoughts & Market Update, I asked if there was a New Bull Market in Housing?

The data is now in, and yes, we are absolutely in a new bull market in housing most likely driven by historic low real-interest rates and a Millennial demographic tailwind.

Zillow projects that home values have risen 5.8% over the past year and that they will rise another 7% over the coming year. To my astonishment, the Seattle housing market has risen 8.9% over the past year and is projected to rise another 8.2% over the next 12 months!

OpenDoor and Zillow are the two companies that I believe are the best positioned to benefit from the secular trends in the housing market. I am strongly considering including them in the Aggressive and Thoughtful Portfolio, but have not brought myself to pull the trigger just yet (Please email me or leave a comment if you have a better name for this portfolio!).

3. Inflation will likely surge in the second half of 2021

We have lived in a deflationary era, or at least an epoch of declining inflationary expectations, since 1980. In fact, every decade since then has had lower average annualized inflation and lower cumulative inflation. During the 2010s, the average annualized inflation rate was only 1.8% and cumulative inflation was the lowest since the 1930s.

Due to the many reasons discussed in many prior posts including Prepare for Stagflation...and Boom?, Why does nobody own Gold?, and August 2020 Thoughts & Market Update, inflation is likely to rise materially in the 2020s.

So, why has there not been a material rise in inflation in 2020 and why will it surge in the second half of 2021?

Inflation will surge when the Coronavirus Crisis ends and consumers start to spend, and commercial banks start to lend the $2.3 trillion in deposits that consumers saved in 2020.

The reason inflation did not rise materially in 2020 is because (1) the mix of goods and services consumers buy changed dramatically in response to Covid (How many vacations are you taking?), and (2) consumers decided to save money instead of spending it.

One of the strangest things that happened in 2020 is that as a result of the CARES Act, the personal savings rate in the United States shot to its highest level on record.

With the exception of people with lower incomes and the unemployed or partially employed, who immediately spent the stimulus funds they received out of necessity, the majority of Americans collectively saved a massive amount of money. This tremendous savings is now piled up to the tune of $2.3 trillion in new deposits at commercial banks, a ~17% increase from February 2020.

Consumer price inflation occurs when too much money chases too few goods and services. That is exactly what I expect to happen as life “returns to normal” in the second half of 2021. Inflationary forces are likely to outweigh the deflationary forces of the “Digital Transformation” that Covid accelerated. My expectation is that Russell Napier’s prediction of 4% inflation by mid 2021 is the most likely outcome.

4. The New Bitcoin Bull Market: DeFi, Corporate Treasuries, and Retail Adoption

At the beginning of the year, I wrote that 2020 would be the “Next Phase of Bitcoin’s Evolution”. This is most certainly true! As of this writing, the price of a single Bitcoin is now approximately $15,400 (with lots of volatility of course!), up nearly 2x year to date. The market capitalization of the Bitcoin network is now only ~9% less than its all-time-high in December 2017!

At the beginning of the year, before the Coronavirus Crisis, I wrote that Bitcoin’s fundamentals would be driven by (1) the Halvening, (2) the proliferation of Bitcoin-backed banking, (3) the growth of decentralized stablecoins, and (4) that Square would build a payments protocol using Bitcoin.

So far, the only one that has not happened is that Square has not launched a Bitcoin payments protocol (yet!). In addition to the Halvening, crypto-backed backing and stablecoins grew at a far faster rate than I thought they would at the beginning of the year.

Decentralized Finance (aka DeFi) grew explosively from less than $700 million in total value locked (TVL) to over $12 billion as of this writing.

Between the WBTC and RenVM protocols, two Bitcoin to Ethereum interoperability solutions, there is now more than $2.2 billion of Bitcoin on the Ethereum network! Even more astonishing is the dramatic pace of growth, when I wrote my last blog post in August, only ~$0.5 billion of Bitcoin was on the Ethereum network. That is an 4.4x increase in just the past two and a half months!

Two additional drivers of Bitcoin demand also emerged much earlier than I had anticipated. The treasury departments of publicly-traded U.S. corporations began to add Bitcoin to their balance sheets and PayPal announced cryptocurrency trading through their platform.

On August 11th, 2020, the CEO of Microstrategy (MSTR), Michael Saylor, announced that the company had adopted Bitcoin as its Primary Treasury Reserve Asset. A little over a month later, he announced that the company had acquired 38,250 bitcoins at an aggregate purchase price of $425 million!

On October 8th, 2020, Jack Dorsey, the CEO of both Twitter and Square, announced that Square had purchased 4,709 bitcoins, a $50 million investment representing 1% of Square’s assets.

Then on October 21st, 2020, PayPal announced it would launch a cryptocurrency service for its 305 million registered customers.

I believe that these 3 growing drivers of Bitcoin demand will propel the market capitalization of the network to new heights over the next two years. I would not be surprised to see Ark Investment’s estimate of a $2T to $3T market capitalization be realized by the end of 2021, implying a price in the range of $100k to $160k per bitcoin.

5. Ethereum: A New, Digital Constitution?

I have always been fascinated by the Ethereum Network. In fact, if you read the About Me page on this blog, you will discover that Ethereum made me a crypto-asset investor. During 2016, I was one of the first thousand data scientists to compete in stock market prediction competitions on with Numer.ai where I was paid in Bitcoin. I registered my Coinbase account so that I could sell the small amount of Bitcoin I earned for a few measly dollars. Now, I laugh when I think about my ignorance then! In Feburary 2017, Numer.ai launched their own token, Numeraire, and distributed it to their first data scientists to incentivize adoption. I was one of those lucky data scientists! Even funnier, I did not know even it at the time!1 Numerai sent me an email telling me about the tokens I had earned, but I didn't even see it because I was so busy with my new job at PrecisionLender! It was not until a friend told me about Ethereum in August 2017 that I realized had these tokens. Upon discovery, I immediately reallocated my Numeraire (NMR) tokens into Bitcoin, Ethereum, Ripple (never ever buy this), and Litecoin. I have been obsessed with the Cryptoasset ecosystem ever since.

Anyhow, Ethereum has always vexed me since I first discovered it. It is an incredible innovation platform that has unlocked as George Gilder puts it, “an amazing efflorescence of creativity”. However, I never had the same level of conviction in Ether (ETH) as an asset that I did with Bitcoin. It’s narrative was complex, murky, and definitely was not as straightforward as Digital Gold.

Regardless, I invested in it because of the innovation happening there, the genius of Vitalik Buterin, and just this sense that I did not want to miss the action.

Last Friday, I tuned it to listen to a “fireside chat” between my favorite economist blogger, Tyler Cowen of Marginal Revolution and Vitalik Buterin on ETHOnline.

The conversation between the two has been stuck in my mind ever since and I am sure I will further write about my thoughts on it in a future post.

Here is what Tyler Cowen said that I found so compelling:

“(In Crypto) governance and institutions are winning in what is a necessary and healthy way, congratulations, but this is a little different than your original vision...Ethereum 2.0 is fundamentally an act of governance and institutional creation, in some ways it’s like the American Constitutional Convention, and not very algorithmic. I think maybe the future for Crypto is you have a bunch of very good institutions evolve, often focused around individuals, just like Jimmy Wales is still important for Wikipedia, no matter how much he does or does not do on a given day, he is like a certifier of trust. And then in the nooks and crannies of those systems, you will have microparts, that say do all Internet transactions with no oracle problem, simply in terms of the original vision (of Ethereum), but whenever you have to interact with the so-called “real-world” it will get back more to governance and trust. People will trust you (Viktalik), and the Ethereum foundation, and Ether more than they trust other institutions. Again not everyone, a lot of people will just never understand what you are doing, but I think we’re in that world already and we’re just going to see this ongoing proliferation of trusted micro institutions that have a very long reach in terms of what they enable people to do...Everything you are doing to make it work better, Proof of Stake, just feels to me like this is an Institution. How it works is not being reduced to a small number of dimensions. That to me is what is striking.”

Given the growth of DeFi, the interoperability of the Bitcoin and Ethereum networks, the upcoming launch of Ethereum 2.0 in December 2020, and Tyler Cowen’s insightful thoughts, I have become the most bullish I have ever been on the Ethereum Network.

I am very strongly considering doubling my position in Ethereum, making investments in promising DeFi protocols, and even launching my own project on Ethereum. I believe this is the space and place to be for my career in the near to intermediate term.

My latest small investment is in the DeFi Pulse Index (DPI) which gives a broad allocation to the highest quality projects in the DeFi space. I am especially fascinated with the idea of creating my own actively managed crypto hedge fund using Ethereum primitives like Set Protocol and Synthetix. The idea of creating a decentralized crypto fund, with allocation to both crypto-native and real-world stocks like Tesla and Square, is very exciting to me.

An ill-formed idea that has been recurring in my thoughts ever since listening to Vitalik and Tyler’s conversation is that the Framers of the American Constitution made Gold the sole legal tender for payment of debts by the United States Treasury. This worked so well for so long because Gold as currency was unalterable by human intervention and the Constitution created a system of checks and balances for human governance rooted in human nature.

If Bitcoin is reinventing Gold, is it possible that Ethereum is reinventing the Constitution?

6. (Decentralized) Prediction Markets Conquered Pollsters in the 2020 Presidential Election

Analyzing political polling data and betting on prediction markets has always fascinated me. A funny story I like to tell people is that I actually lost $4k on PredictIt by betting that Marco Rubio would win the 2016 Republican nomination for the presidency. Now, that makes me laugh when I think about it!

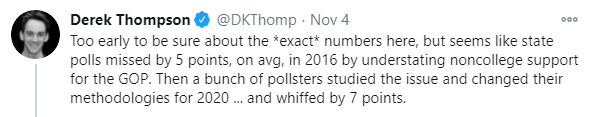

Throughout the course of the 2020 election, I wondered if the polls were right that Joe Biden really did lead Trump by anywhere between 5 to 10 percentage points. I thought that Joe Biden had the edge, but the forecasted margin of victory felt off to me given the closeness of the 2016 election and the widespread polling errors that favored Democrats in the elections of 2014, 2015, 2016 and 2018.

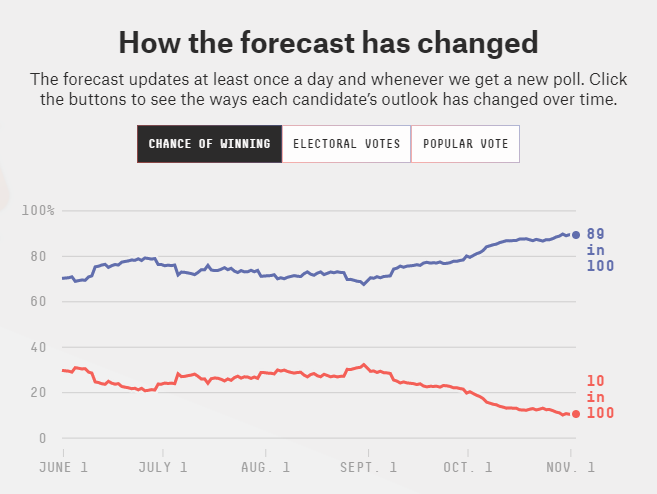

FiveThirtyEight’s election forecast never gave Trump more than a 32% chance of winning the election, and on election day, gave him only a 10% chance of winning.

On the other hand, prediction markets told a very different story. They never gave Trump below a 34% chance of winning, with a 35% chance on election day, 3.5x the likelihood implied by 538’s forecast.

On November 3rd, the verdict was delivered. Pollsters were crushed and the prediction markets looked to have been right all along about Trump’s and the Republican’s relative chances. The most egregious polling errors in the U.S. elections were in the Wisconsin presidential race, the Maine Senate race, and the U.S. House of Representatives.

On election day, 538 gave Trump just a 6% chance of winning Wisconsin and the RealClearPolitics polling average had Trump losing to Biden by 6.7 percentage points. It appears likely that Biden will prevail by only 0.7 points in Wisconsin, a 6.0 percentage point polling error far outside the margin of error. ABC News, an A+ rating pollster by 538, projected Biden would win by 17 points. Shameful!

In the Maine Senate election, the RealClearPolitics polling average had incumbent Republican Senator Susan Collins losing to her democratic challenger by ~5 points, not a single poll indicated Susan Collins would win. Regardless, she carried the state by nearly 9 points!!

For the U.S. House of Representatives, the RealClearPolitics polling average had the Republicans losing by 6.8 points on election day; they narrowly lost by 1.0 point.

If you relied only, or mostly, on the polls to forecast the outcome of the 2020 U.S. elections, you got crushed. I agree with Vitalik that prediction markets prevailed over polls this year!

In addition, the first decentralized crypto prediction markets took off. Catnip.exchange, powered by Augur, had about ~$8 million in betting volume on election day and Polymarket, a prediction market built on an Ethereum sidechain, had comparable trading volumes. Decentralized prediction market volume blew past the measly sub-$1m trading volume on centralized counterpart PredictIt , but was still a far cry from the over $230 million in volume that centralized Intrade saw during the 2012 U.S. presidential election before being shut down by governments.

I believe that decentralized prediction markets proved themselves in this election cycle and we will see much greater volumes in the elections of 2022, 2024, and beyond!

7. Personal Note: I caught a giant Chinook (King) Salmon in early October!

Chinook Salmon in Hood River, OR.