August 2020 Thoughts & Market Update

1. Twitter and the Aggregation Theory of Investing

One of my favorite questions that Peter Thiel poses in Zero to One (my favorite business and philosophy book) is “What important truth do very few people agree with you on?”

I have two truths that are contrarian in my social circles.

The first is that a well-curated Twitter is one of the best sources of highly valuable information.

The second is that the Efficient Market Hypothesis (EMH), widely taught in business and economics programs in colleges and universities, is total bullshit.

Thus far in 2020, the Aggressive and Thoughtful investment portfolio has returned 171%. This compares to 4% for the S&P 500, 24% for the NASDAQ, and 26% for Gold.

Under the EMH, my portfolio’s out-performance is either impossible or completely due to luck. The EMH is incomplete because it fails to incorporate Information Theory into its model of reality, and it’s worse than unhelpful because it is a self-fulfilling and demotivating ideology. If it’s only possible to beat the 7% annualized returns of the market through luck, why should you even bother trying?

At its best, the EMH is a check on uninformed retail stock trading (my guess is most of these kinds of people have not even heard of the EMH). In reality, the EMH is loserthink that has led to the explosion of so-called passive investing and saps the agency of well-informed investors.

Although I did not have a name for it at the time, I constructed the Aggressive and Thoughtful portfolio with the Aggregation Theory of Investing using Twitter to discover the research and theories of exceptional traders, investors, and entrepreneurs.

Source: Qiao Wang on Twitter

I have done very little, if any, of my own original investment research. However, one advantage I have is that I am what my favorite economist, Tyler Cowen, calls an Infovore. I use Twitter to discover many different, oftentimes contrary, opinions from exceptional people and then I synthesize their views into my own. In Data Science, this is called ensembling, where you take many uncorrelated models and aggregate them into a single model that outperforms any individual model alone. The miracle of ensembling is the secret of the Numerai hedge fund that first sucked me into Bitcoin, Ethereum, and the Crypto Revolution.

So, whose thinking did I aggregate and synthesize to construct the Aggressive and Thoughtful portfolio?

Peter Thiel: Tesla, Bitcoin

Catherine Wood: Tesla, Bitcoin, Square

Balaji Srinivasan: Bitcoin, Ethereum

Ray Dalio: Gold, Bitcoin

Richard Craib: Numeraire, Augur

2. The Rise of Gold

At the beginning of this year, I wrote a blog post asking Why Does Nobody Own Gold? Since January 1st, Gold rose in nominal dollar terms from $1,545 per ounce to an all-time high of $2,051 on August 6th, a 32.7% rise while the S&P 500 only increased 3.9% over the same time period.

The sharp run-up in the price of Gold has been driven by zero, or even negative, interest rates and the largest government budget deficit since WWII financed almost entirely by the printing of money.

In his excellent piece, The Great Monetary Inflation, the billionaire investor Paul Tudor Jones makes the case for investing in Bitcoin, but also gives an estimate of where Gold is headed:

“Speaking of gold, in a low-carry world, gold remains a very attractive hedge against the Great Monetary Inflation and hedges against other risks clouding the outlook, including a renewed flare up in the China-US relationship where financial sanctions could eventually be used in a brute-force decoupling. How far can gold rally from its current price? A simple metric based on the ratio of the value of gold above ground to global M1 suggests gold could rally to 2,400 before it reaches valuations consistent with the lowest of the last three peaks in this valuation metric and 6,700 if we went back to the 1980 extremes. One thing is for sure, these are going to be incredibly interesting times.”

Source: The Great Monetary Inflation

Due to the rapid paradigm shift as a result of COVID-19, I made a tactical allocation change to my investment portfolio on April 13th. I sold all of the stock-based index funds in my employer 401(k) to buy a gold miner index fund (OGMIX). Gold miners now represent approximately 7% of my investment portfolio.

3. Bitcoin’s Total Addressable Market (TAM) is Growing

I have often noted that a single bitcoin would be worth nearly $400k if Bitcoin surpasses Gold’s market capitalization of roughly $8 trillion. Assuming that Paul Tudor Jones is right and Gold appreciates in value by 2-3x, using the same approximation means a single bitcoin could be worth $1 million to $2 million!!!

Source: Me!

4. A New Bull Market in Housing?

I recently moved from Raleigh, North Carolina to Seattle, Washington and purchased my first home. There were a few times in the past few years where I seriously considered buying a house but was never able to pull the trigger. One of the major factors in my decision was that it became significantly more affordable to purchase a home due to falling interest rates. I also became more bullish on housing as an investment. Why? I believe that real interest rates will be negative over the next decade which will benefit holders of real assets (i.e. Gold, Bitcoin, and Real Estate) and holders of dollar-based liabilities (i.e. fixed rate mortgage loan). Because of this, I made the observation on Twitter that being long Gold, Bitcoin, and the 30-year fixed mortgage are all variants of the same trade!

Let’s dig into this a bit more. Here’s a excerpt from an interview with the Scottish investor, Russell Napier:

“If we’re taking the next 10 years, I see inflation between 4 and 8%, somewhere around that. Compounded over ten years, combined with low interest rates, this will be hugely effective in bringing down debt to GDP levels. ”

Over the past few months, 30-year fixed mortgage rates have been hovering around 3%, the lowest ever recorded. If the inflation rate rises to 4% then the real interest rate will be -1%, and if inflation rises to as high as 8% then the real interest rate will fall to -5%. This means that over the course of a decade that inflation alone would pay off between 10% and 40% of a 3% fixed rate mortgage! Not only would the rise in inflation benefit those with dollar-based liabilities (i.e. mortgage borrowers, student debtors), but it would also boost the demand for housing. I am bullish on home prices because (1) home prices typically rise along with inflation, and (2) millennials will likely provide a demographic tailwind to the U.S. housing market over the next decade.

5. Decentralized Finance (DeFi) is Booming on Ethereum!

In my May 2020 Market Update, I wrote that Bitcoin was exploiting its currency network effect on Ethereum and shared this chart from DeFi Pulse showing that $25 million worth of Bitcoin had been moved onto Ethereum.

In less than 4 months, the total value of Bitcoin locked on Ethereum has grown over 20x between the WBTC and RenVM protocols!

I anticipate more cross-chain protocols will likely emerge over the coming year, and it would not surprise me if the total value of Bitcoin on Ethereum increased another 20-100x from current levels.

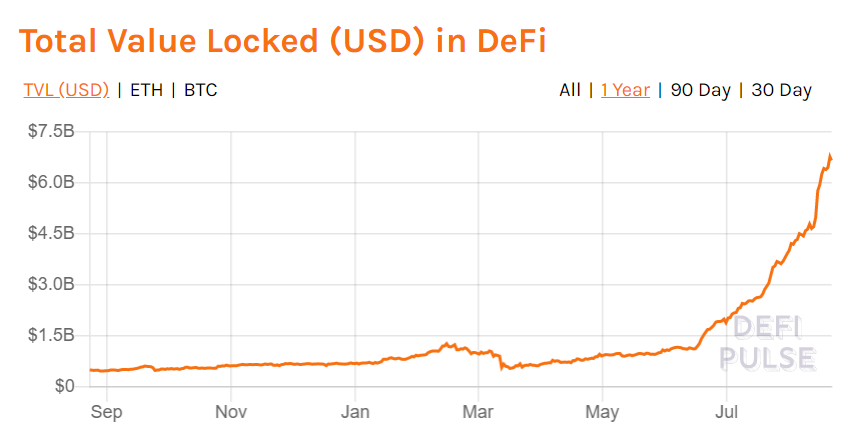

It’s not only Bitcoin growing on Ethereum - the entire Decentralized Finance (DeFi) ecosystem has grown nearly 10x in 2020 alone!

I find the design space for building financial applications on Ethereum to be incredibly exciting!

I see Ethereum as the platform where I am most likely to build and launch my own company or protocol over the coming year.