How many ₿itcoins do you have?

I have multiple Bitcoin t-shirts, had a Bitcoin bumper sticker on my car for a year, own and run a Casa Bitcoin Node (you probably don’t know what this is), read obsessively about Bitcoin on #cryptotwitter, and talk about it every chance I can get with friends, family, and even coworkers.

Wearing my favorite Bitcoin t-shirt.

The question I hear from people the most about my obsession is, “How many Bitcoins do you have?” I cannot help but laugh when some of the most polite, socially considerate people I’ve ever met are essentially asking me a question that is the equivalent of, “How much money do you have in your bank account?” It could be considered rude if it were not so bizarre.

It amazes and astounds me that nearly two years after the Bitcoin Boom and ICO Bubble, and over ten years since the release of the Bitcoin software, the vast majority of the public of all generations, is either misunderstands the technology or is completely unaware of its existence.

Many have compared the emergence of Bitcoin to the dawn of the Internet in the 1990s. I believe that the massive change Bitcoin will bring to our world will be closer on the scale to the creation of the United States Constitution in 1789 than the Internet in the 1990s.

The fundamental question people should be asking is, “Why does Bitcoin matter?” Before this question can be answered, one must first understand what Bitcoin is.

What is Bitcoin?

“When someone finds Bitcoin for the first time, they tend to focus on one of its many very interesting features...All of these features are incredibly attractive, and we gravitate towards them too quickly. We miss the bigger picture of why Bitcoin matters...Bitcoin matters because it may be the best form of money we have ever seen.”

- Wences Caseres, Bitcoin: the New Gold Standard (2015)

Bitcoin is a non-political, sovereign digital currency. What does this mean? How is Bitcoin different from other currencies like the US Dollar ($), the Euro (€), or the Japanese Yen (¥)?

Bitcoin is sovereign because it is not controlled by any government or corporation, but instead is run by a peer-to-peer distributed network of computers that enforce the rules of the Bitcoin protocol.

It is non-political because it transcends national borders and its monetary policy is set by the rules of the protocol. This means that the number of bitcoins is fixed; there will only ever be 21 million bitcoins created. The rules governing the number of bitcoins and their creation were defined in the original release of the Bitcoin software in 2009, and have never been, nor will ever be, altered. This is very different from the currencies of nation-states like the United States, the United Kingdom, or Japan, where central banks can alter the amount of issued currency at any time.

Why does Bitcoin remain so underestimated?

“ [Bitcoin] strikes me as deeply contrarian...There are no Wall Street analysts, Wall Street banks, that are pushing this in any way whatsoever. It has been missed in New York City, it has been missed even more shockingly in Silicon Valley, and it’s a technology that has emerged in a fairly distributed way...My view is that there will be one cryptocurrency that is the equivalent to Gold.”

- Peter Thiel, Founder of PayPal and Investor in Facebook (March 2018)

Over a year since Peter Thiel spoke at the Economic Club of New York, Bitcoin remains severely underestimated. This serious lack of awareness and fundamental misunderstanding persists despite that in 2019 alone...

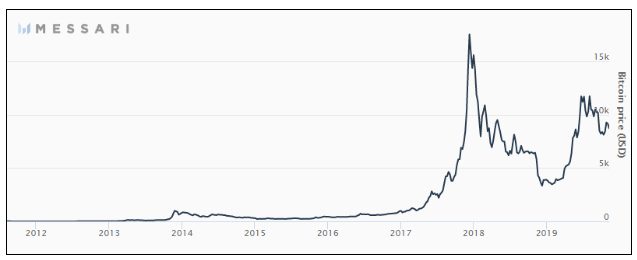

Bitcoin has resurged to nearly 50% of its all-time high price of almost $20,000 for a total market capitalization, as of this writing, of ~$160 billion.

Souce: Messari

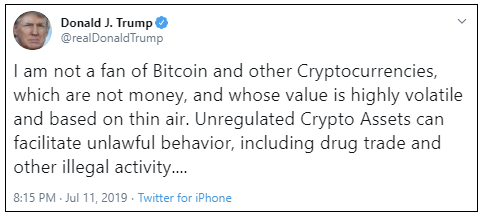

The two most powerful leaders in the world, Donald Trump and Xi Jinping have both publicly commented on Bitcoin.

Facebook has launched a new global currency initiative called Libra inspired by Bitcoin and other cryptocurrencies with an association of participating corporations.

Bitcoin is easily and readily purchasable with US dollars on Coinbase, Cash App, and a multitude of other web applications.

So, why does Bitcoin remain so underestimated in spite of these developments?

I believe the primary reason Bitcoin remains undervalued is that the history and role of gold in human society are not well-understood, and fundamentally Bitcoin is Digital Gold.

As a money, Bitcoin is more comparable to gold than nation-state currencies like the US dollar because it is a non-political currency. Gold cannot be turned into lead, at least without a particle accelerator, ensuring the total supply of gold in the world is independent of human affairs. Gold became a dominant storehold of wealth not because it is scarce, but because its inflation rate is lower than any other commodity on Earth approximately 1.5% per annum compared to silver (~4.5%) and platinum (~91%).

Gold is an $8 trillion market that most individuals do not understand. Governments and central banks stockpile gold because of its unique value. It is estimated by the World Gold Council that ~190,040 tonnes of gold have ever been mined throughout history. The New York Federal Reserve houses 6,190 tonnes of gold for various world governments on the bedrock of Manhattan Island.

In addition, the United States Department of the Treasury stores 4,580 tonnes of Gold at Fort Knox, Kentucky.

Gold became the first universally accepted form of money, and remains valuable in the 21st century because of attributes that made it uniquely suited for being a universal currency. Bitcoin is a vastly superior form of money to Gold along nearly every one of these dimensions.

Bitcoin is more scarce than Gold; there will only ever be 21 million bitcoins whereas between 2,500 and 3,000 tonnes of gold is mined every year.

Each bitcoin is divisible into 100,000,000 pieces called satoshis via a computer keystroke whereas gold must be melted to form quantities of varying size and mass.

Bitcoins are vastly more portable than gold, and can be sent nearly instantaneously anywhere on the planet within ~10 minutes. Gold’s mass oftentimes makes it prohibitively expensive to move, and can take days, weeks, or even months to arrive to its destination.

Bitcoins are virtually indestructible, and cannot be purposely destroyed. Like gold, bitcoins can be lost or go missing.

Bitcoin is recognizable via its open-source software that can be downloaded from the Internet , whereas the authenticity of gold must be verified via assay or weight with scales.

Fungibility may be the one attribute where gold trump’s Bitcoin because of the traceability of Bitcoin transactions. However, multiple teams of engineers are making rapid progress in making Bitcoin transactions fully private without sacrificing its other attributes.

Why own Bitcoin?

“I believe there is a 50% chance that one bitcoin is worth more than $1,000,000 in the next 10 years, or over 300x more than it is worth right now. The potential reward is so big that it makes sense to own some and to hold it for a long time. Even a small amount can change your life.”

- Wences Casares: Why Own Bitcoin (June 2017)

The primary use case for both Gold and Bitcoin is as a non-political storehold of wealth. An intelligent investment in Bitcoin is a wager that Bitcoin will unseat Gold as the world’s dominant non-sovereign store of value.

If the price of a Bitcoin reaches $1,000,000, Bitcoin’s total market capitalization would be $21 trillion, dwarfing all of the technology giants we know today combined.

Bitcoin ($1 million): $21 trillion

Gold: ~$8 trillion

Google, Apple, Facebook, Amazon, Microsoft (2019): $4.5 trillion

US Monetary Base: ~$3 trillion

At this point, you may be saying to yourself, “Come on Thomas, how can you possibly believe that the potential market capitalization of Bitcoin is in the trillions of dollars?!”

As Kyle Samani from Multicoin Capital writes in $100 Trillion, the potential market for cryptocurrencies is far larger than most people believe. He breaks down the opportunity for cryptocurrencies like Bitcoin into five categories, including a category for Digital Gold, which he estimates has a total market potential of $30 - $70 trillion. He believes that cryptocurrencies, “will consume the vast majority of the market value of gold” and that they will also dramatically expand the size of the digital gold market due to the ease which cryptocurrency can be stored on simple smartphone with an internet connection.

If Bitcoin reaches a market capitalization of $30 trillion, the lower end of the Digital Gold opportunity alone, each bitcoin would fetch a price of ~$1.4 million, whereas reaching the high end estimate of $70 trillion would imply a per bitcoin price of ~$3.3 million.

I’ll close with a parting question: How many bitcoins should I have?